Attacks on CZ UniCredit Bank clients

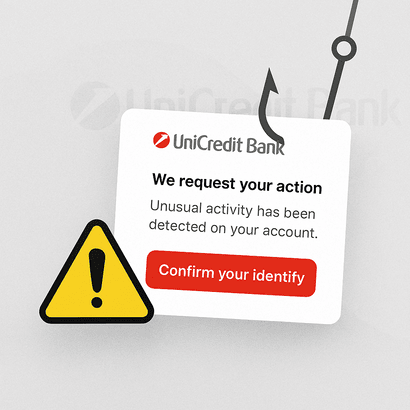

Recently, a wave of phishing attacks has been targeting Czech clients of UniCredit Bank. Here’s how this kind of scam works, what to look out for, and how you can protect your bank account.

TL;DR

Scammers are sending fake emails pretending to be from UniCredit Bank . They claim there is unusual activity on your account and ask you to confirm your identity by clicking a link and filling out your personal information. Once you click, you are redirected to a fake banking website that looks almost identical to the real one. When you enter your login information, the attackers gain full access to your bank account and your money.

-

Always double-check the email sender.

-

Never click on links in suspicious emails or SMS messages.

-

Contact your bank if something does not seem right.

-

If you are stolen from, do not hesitate to contact the police.

How Does It Work?

You see an official-looking email in your inbox, often with the bank’s logo, layout, and tone. The email usually says something alarming, to make you feel as if there is no time to waste. The desired result is to make you feel scared and urgent, so that you do not think about the email too deeply.

In this specific case, the scammers claim that due to suspicious activity, your account has been temporarily blocked. They are asking you to confirm your identity to restore access to your account.

As it usually is, a link is present to make your sign in easier, however, it leads to a fake website, such as aktualizaceuctu.unicreditgroups.cz, aktualizaceuctu-unicreditgroups.eu, unicreditbank-cz.net or unicredit-check.com, imitating the real UniCredit login page.

❗ The real link to the UniCredit Bank's page is either unicreditbank.cz for the Czech Republic or unicreditgroup.eu for Europe in general.

Once you enter your login details, they are sent directly to the scammers, who immediately gain access to your real account.

How these phishing scams are fought against

The websites that the links lead to should be blocked as soon as possible, however:

- for the pages to be blocked, they need to be reported first, and

- even if a page is blocked, it is always possible to create a new one.

The only way to solve both of these problems is to make sure you are able to recognize signs of phishing and know which steps to take after you do.

How to recognize phishing

The obvious way to recognize phishing is to look for anything suspicious.

-

Asking for your password - your bank will never ask you to send or fill out your password via email.

-

Check the email address - make sure the emails you receive are really sent by your bank.

-

Check for any grammatical errors or incorrect information.

-

Look out for unusual formatting - if the email looks a little bit different than the emails your bank usually sends, it might be a sign of phishing.

-

See where a link leads to before you click it - make sure that the link in the email truly belongs to your bank. However, even if it does, it might be better to visit your internet banking the way you usually do, just to be safe.

What to do if you come into contact with phishing

-

Do not respond to the email.

-

Do not fall for lies - be aware of your transactions. If an email claims something untrue about your transactions, make sure to report it to your bank. Automatic emails/sms messages about your real spending might be helpful to stay in touch.

-

Contact your bank - if you are unsure, your bank's customer centre can help you determine whether the email you received is real or a case of phishing

-

Change your login information immediately - the sooner you figure out that your information has been stolen, the better. If you act fast, you might be able to change your passwords before anything worse happens

-

Inform the police - if you have been a victim of a phishing fraud and had your money stolen, do not hesitate to contact the police.

Final Recommendations for Your Safety

Stay informed! Read our blog and follow notifications in the Redamp.io app to stay updated on the latest threats we monitor for you.